CLICK HERE TO BOOK AN ERC EVALUATION NOW.

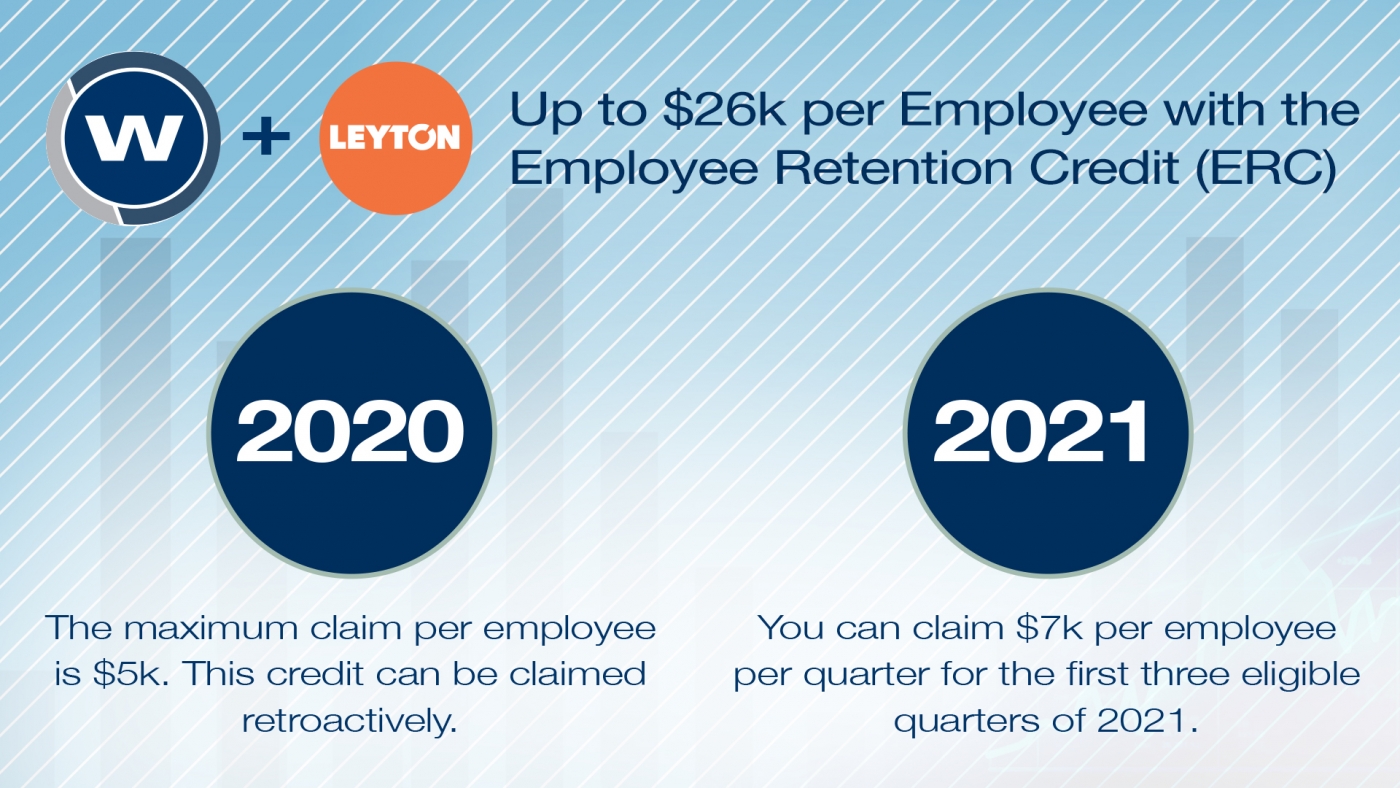

The Employee Retention Credit (ERC) is a program created in response to the COVID19 pandemic and economic shutdown, which incentivizes businesses with a refundable tax credit for maintaining their payroll during 2020 and 2021. Qualifying employers can claim up to $26,000 per employee. Employers who took PPP loans may be eligible (see below).

Eligibility depends upon the size of the employer. You cannot double dip by taking into account wages paid with PPP funds, WOTC, employer sick and leave credits, research tax credit wages (for 2021). Qualified wages include wages paid from 3/13/20 through 12/31/20 for the 2020 credit and 1/1/21 and 9/30/21 for the 2021 credit.

If you received PPP Loans:

- The same wages used for forgiveness cannot be used for ERC

- This double dipping is prevented because an eligible employer is deemed to make an election not to consider qualified wages reported on the employer’s PPP Loan Forgiveness Application for purposes of claiming the ERC

- If forgiveness application has not been submitted yet, it makes sense to keep the payroll portion of forgiveness to the minimum (60%) and maximize the other items

- If forgiveness has been received, wages used for forgiveness cannot be used in the ERC and the forgiveness application cannot be changed

How do I Qualify?

- You experienced a significant decline in gross receipts

- Your business had to close (partially or fully) due to COVID-19

- You may be qualified now even if you were not in 2020

- This credit can be claimed retroactively

How Leyton Helps

- Leyton makes claiming ERC easy and worry free for our clients

- We will determine the qualified wages paid to employees during relevant time periods

- We’ll calculate your ERC for all applicable financial quarters during 2020 and 2021

- Leyton does it the right way – although we’re timely, we do not rush\

- We look at each client’s unique situation

- We can navigate the interactions between your PPP loans and other credits to help you ensure IRS compliance and reduce audit risk.

- We’ll prepare a detailed and industry-leading summary report to substantiate your credit per employee

ERC Benefit Explained - Webinar

Steve Abernathy will review the scope of the credit and the exclusive partnership between Leyton and the WFCA to help our members determine their eligibility as well as complete the tedious application process to secure the funding.

The Webinar has concluded. You can view the video from the presentation here. You can view the presentation materials by clicking the button below.

8.8.23, Asking the Obvious, Tom Jennings

In this week’s edition of Tuesday Tips featuring Tom Jennings, Tom reminds us to always remember to talk about WHAT the product does for the customer, not HOW it does it.

Sign up for an ERC Evaluation with Leyton

Ensure your maximum return from the ERC. Sign up with Leyton today to learn how this program can add money back to your bottom line. Through partnership with the World Floor Covering Association, book a complimentary, no commitment meeting with Leyton. We’re here to help you discover how much you’re eligible for. Click below to book an ERC eligibility evaluation today.

8.1.23 - CHIPD, Josh Young

Looking for ways to add to your bottom line? Take advantage of the WFCA-exclusive partnership with CHIPD. In this week’s edition of Tuesday Tips, Josh Young showcases a quick way to add dollars by shaving fees and optimizing the efficiency of your credit card processing.

If you are looking for past versions of Profit Matters including videos and presentation materials, please click here.